AboutThe 8-Minute Rule for How Long Does Dui Affect Insurance Rates? - Wallethub

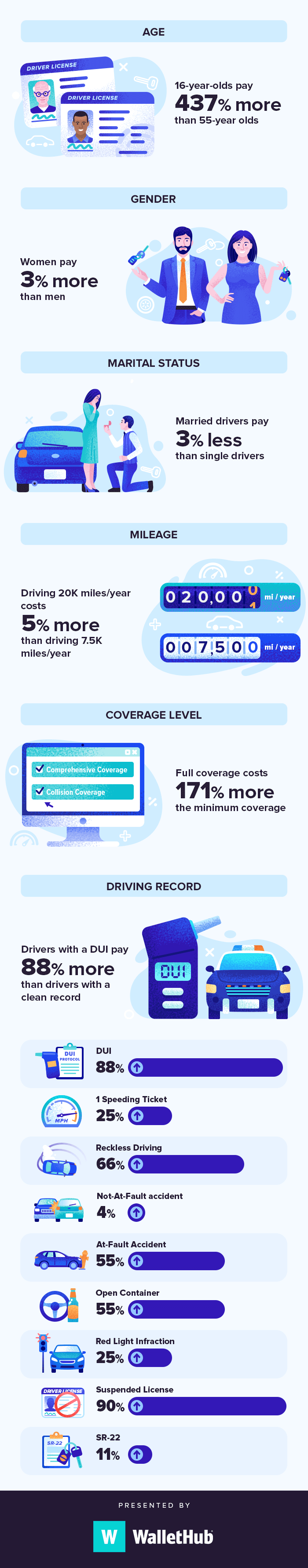

In the wake of a DRUNK DRIVING fee, your ideal wager is to compare cars and truck insurance coverage prices estimate from as many firms to locate the insurance policy coverage that fits you. What occurs to automobile insurance coverage after a DUI? Your insurance policy rates will probably rise as well as they might escalate, Insurance provider estimate post-DUI auto insurance policy rates could increase by anywhere between 30% to 100% (or by a lot more).

You might encounter higher auto insurance policy rates for several years to find, You can anticipate to pay out a boosted cars and truck insurance premium for at the very least 3 years complying with a DRUNK DRIVING. In some states, the costs will certainly remain filled with air as long as a DUI remains on file. Find out more about this at .

An SR-22 type is a "statement of economic obligation," which is typically filed by an insurance policy business or agency on your part. Your vehicle insurance policy price isn't the only point that changes after a DUI.

Also if you are enabled to keep your chauffeur's license and your driving advantages, your state will usually need you to submit an SR-22 (or FR-22). This certification of monetary duty confirms you have actually bought a minimum of the minimum amount of vehicle insurance policy called for by your state. Many of the moment, your insurance coverage firm will file these for you normally for a cost yet if they don't, you would need to talk with your state's division of automobile.

How Dui Insurance - Get Affordable Insurance After A Dui ... can Save You Time, Stress, and Money.

If this triggers an insurance policy gap, these motorists may be relegated to only being eligible for bodily injury obligation to various other vehicle drivers, if in an accident. Because driving without insurance policy in GA is a new crime, that is a terrible option. Judges who decide sentencing on such a sentence do not have a feeling of humor regarding the lack of DRUNK DRIVING automobile insurance policy when medical costs from injuries or a considerable case for residential or commercial property damages exists.

If a high-risk policy is used, the common cost insurance policy coverage will certainly be shed for a person who has actually either been convicted of driving under the influence or has actually had a management certificate suspension activity (based on a DUI arrest with a high BAC or a DUI rejection) on their Georgia DDS (DMV document) history.

Numerous nationwide vehicle insurance provider like State Farm will certainly reject individuals as soon as possible when they learn of a pending Home page DRUNK DRIVING case. The majority of states have privacy waivers that permit insurance provider to examine their insureds' driving backgrounds at the DMV, DPS, BMV or DDS in your state. Plus, every state has an available digital approach of recording which drivers are insured as well as which chauffeurs have actually had an insurance termination or gap in coverage.

Without a doubt, one of the most corrective feature of DUI laws is the complete absence of a mechanism to get rid of a DUI from your criminal history. A lot of states (MS, NJ, AL, WA, OR, IL) have some technique for an initial time DUI transgressor to get diversion, expunction, or (after a long time) be able to make an application for a document limitation.

How Long Does A Ticket Stay On Your Car Insurance? Fundamentals Explained

A certification shows that you have the Evidence of Insurance policy Certificate called for to reinstate your driver's license. An SR-22 Proof of Insurance Policy Certificate is more than the regular insurance coverage card that is sent out by car insurance coverage business. The SR-22 Insurance Policy Certificate is only needed by those that have actually been convicted of driving drunk or otherwise been the topic of suspension or revocation due to the suitable state's DDS, BMV, SOS, DMV or DPS administrative driver's permit action.

After your apprehension, speak to a DUI lawyer at Goldman Wetzel and have her advice you on how to handle the discussion with your insurer. Exactly how a lot you'll pay for your insurance depends on a range of aspects, including your driving document. Being convicted of driving under the impact (DUI) or driving while intoxicated (DWI) could trigger your rates to go up.

https://www.youtube.com/embed/9yWO4xTxN4E

Other substances can consist of illegal drugs, along with specific prescription medications and over the counter drugs. Some states may consist of family chemicals used as inhalants, such as paint thinner or glue, in that group also. States vary in regards to the fines they enforce when a driver is convicted of a DUI or DWI infraction.